India & Thailand Emerge as Asia's New Semiconductor Manufacturing Twins

In the heart of the modern-day technology revolution lies the Semiconductor chips. The brains of every electronic system and equipment, from iPhones to toasters, data centers to credit cards, chips are the lifeblood of the modern economy. The car you drive would probably have over a thousand chips, each controlling a distinct aspect of how the car works. Even the futurtechs like quantum computing and artificial intelligence that continue to revolutionize the world are powered by semiconductors. According to the reports, the Global Semiconductor Market was valued at $ 466.32 billion in 2022 and is forecast to reach $ 908.92 billion by 2030.

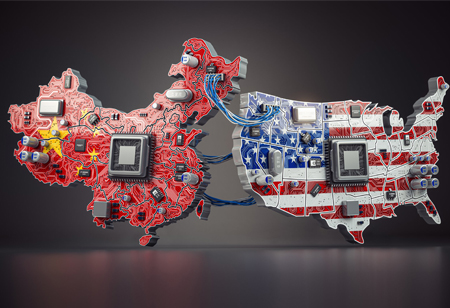

The US and China are engaged in a technological arms race centered on semiconductors. China restricted the shipments of germanium and gallium, two specialized metals essential in producing semiconductors and electronics, escalating the ongoing chip war. Days earlier, the Netherlands had put fresh limits on the shipment of the sophisticated chip manufacturing equipment from Dutch company ASML to Beijing after consulting with the US.

Chip War

Although Beijing produces 60 percent of the world's germanium and 80 percent of the world's gallium, analysts think the export limits won't have a significant impact because other nations also produce these metals, and alternatives are available. Most commonly, computers, defense, and renewable energy technologies use germanium and gallium. Germanium is crucial for low-carbon technology like solar cells, but a well-known American company, Wafer World Inc., claims that semiconductor wafers built with gallium arsenide rather than silicon can operate at higher frequencies and can withstand heat.

Even if the effects of China's action may not be severe, they serve as a message to the US and its allies that China has sufficient retaliation options to prevent them from further restricting its access to semiconductors and the technology needed to make them. Additionally, it draws attention to the potential for the ‘chip war’ to worsen with additional tit-for-tat limitations.

To gain a position on Asia's chip-making map, India and Thailand have entered a full-fledged battle for semiconductor manufacturing investment. India has emerged as a competitor to China and the US in the chip competition. It is also taking advantage of every chance to establish itself as a significant player in the supply chain. New chances will arise as India continues on its road to transformation. India is becoming a top semiconductor investment destination.

India Striving to Position in Asia's Chip making Map

“As India moves forward on the path of reform, new opportunities will be created. India is becoming an excellent conductor for semiconductor investments,” PM Modi says.

According to the Electronics Ministry, the Modified Program for Development of Semiconductors and Display Manufacturing was authorized by the Indian government in 2021 with a budget of Rs. 76,000 crores. The program intends to offer enterprises involved in silicon semiconductor fabs, display fabs, compound semiconductors, silicon photonics, sensors, semiconductor packaging, and semiconductor design attractive incentive support.

According to reports, the request of Micron Technology to establish a semiconductor unit with a capital investment of Rs. 22,516 crore (2.75 billion dollars) was accepted by the government on June 14 in an effort to make India the next major chip manufacturing market. DRAMs, Flash memory, and solid-state devices will be produced at this Micron manufacturing plant.

According to reports, American chip-making equipment manufacturer Applied Materials and Taiwan's Hon Hai Precision Industry, or Foxconn, are collaborating to create similar machinery in the state of Karnataka. Concerns about India's infrastructure, including its electrical supply, remain deeply ingrained.

Foxconn has canceled a separate semiconductor partnership in India, highlighting the conflicting emotions within the sector. However, according to Noboru Yoshinaga, executive vice president at Japanese chip-making equipment manufacturer Disco, the fact that American players are opening up shop in India indicates that the tide has changed.

Japan, which has businesses with strengths in front-end procedures and chip-making machinery, and India are expanding their collaboration. A Memorandum of Understanding between the two countries on fostering collaboration in the semiconductor supply chain was signed in July. Chip businesses stand to gain from the Thai government's expansion of corporate tax benefits. For instance, the corporation tax exemption now lasts for up to 13 years instead of the previous maximum of eight years for a company entering Thailand from upstream in the supply chain.

Thailand is interested in luring businesses involved in front-end operations, like developing semiconductors and etching wafers. These procedures are thought to be more technologically sophisticated than back-end procedures like dicing and packaging. Thailand is also creating a domestic sector that unites suppliers and production lines for electric vehicles. A domestic EV industry would give Thailand an advantage in attracting foreign investment since EVs are anticipated to contain more semiconductor devices than gasoline-powered vehicles. A number of governments, including those in India and Thailand, have learned to pay close attention to how chip companies change their positions. According to reports, Thailand is considered a neutral nation where people can flee the Sino-American tensions.

How did Taiwan emerge as the leader of the semiconductor industry?

Taiwan has recently become one of the top producers of semiconductors. The US previously controlled the industry for many years following World War II. Transistors, a crucial part of semiconductors, were created in the US. The US also led the way in developing microchips by making them more potent, more affordable, and smaller.

But in the 1990s, in order to restore its competitive edge against East Asian rivals like Japan, South Korea, Hong Kong, and Singapore, the US opted to offshore production to Taiwan and South Korea, which offered inexpensive labor. Morris Chang formed Taiwan Semiconductor Manufacturing Company Limited (TSMC) in 1987, and this significantly aided in TSMC's growth. Graduates of Harvard, Stanford, and MIT, Chang had good ties to the US semiconductor business, and American chip designers were his clients.

Today, TSMC controls around 55 percent of the global market for contract chip fabrication, a share that is far higher than OPEC's 40 percent market share for oil. The Soviet Union attempted to establish its own Silicon Valley during the Cold War. Miller claims that they were unsuccessful because they concentrated primarily on extensive espionage activities to imitate American microprocessors, which ultimately led to the production of subpar semiconductors.