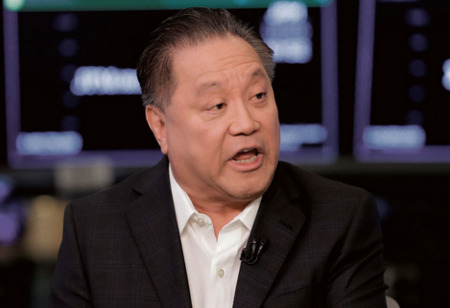

Broadcom CEO Promises Big Improvement for AI Outlook in 2026

Broadcom Inc. Chief Executive Officer Hock Tan informed investors that the chipmaker's outlook for artificial intelligence is expected to improve "significantly" in fiscal 2026, which will help alleviate concerns regarding slowing growth.

Tan mentioned that the company is collaborating with potential customers to create AI accelerators — a sector currently led by Nvidia Corp.

Previously, Tan had indicated that AI revenue for 2026 would exhibit growth comparable to the current year — at a rate of 50 percent to 60 percent. However, with the addition of a new customer that he described as having "immediate and quite substantial demand," the growth rate is anticipated to accelerate in a manner that will be "fairly material," according to Tan.

Also Read: Can The Future of Plastics Be Eco-Friendlier? Terrestrial Insects Show the Path

“Last quarter, one of these prospects released production orders to Broadcom,” he said, without naming the customer. “We now expect the outlook for fiscal 2026 AI revenue to improve significantly from what we had indicated last quarter.”

Initially, Broadcom's quarterly results elicited a lukewarm response from investors, indicating that they were expecting a more significant return from the AI surge. Following some fluctuations after the report, the stock rose by over three percent during the conference call.

There were high expectations leading up to the earnings report. Broadcom's shares have more than doubled since reaching a low in April, contributing approximately $730 billion to the company's market value and positioning them as the third-best performer in the Nasdaq 100 Index.

Investors have been looking for signs that tech spending remains strong. Last week, Nvidia gave an underwhelming revenue forecast, sparking fears of a bubble in the artificial intelligence industry.

Though Broadcom hasn’t experienced Nvidia’s runaway sales growth, it is seen as a key AI beneficiary.

Customers developing and running artificial intelligence models rely on its custom-designed chips and networking equipment to handle the load. The shares had been up 32 percent for the year. During the call, Tan said he and the board have agreed that he will stay as Broadcom CEO until 2030 “at least.”

In the third quarter, which ended Aug. 3, sales rose 22 percent to almost $16 billion. Profit, excluding some items, was $1.69 a share. Analysts had estimated revenue of about $15.8 billion and earnings of $1.67 a share.

Broadcom's Tan has been enhancing the company's networking equipment to improve the transfer of information between the expensive graphics chips that are central to AI data centers. His recent remarks indicate that Broadcom is also advancing in identifying clients interested in custom-designed chips for AI applications.

Also Read: Vietnam's Coffee Industry is Straining Challenges to Achieve Sustainable Development

Tan has leveraged years of acquisitions to transform Broadcom into a vast software and hardware powerhouse. Besides the AI initiatives, the Palo Alto, California-based firm produces connectivity components for Apple Inc.'s iPhone and markets virtualization software for network operations.