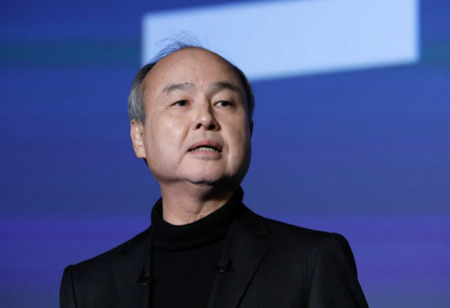

SoftBank Sells Nvidia Stake for $5.8 Billion in Surprise Move

SoftBank Group Corp. completely divested its ownership in Nvidia Corp., generating a substantial profit of $5.8 billion, in preparation for a series of strategic investments planned by its founder Masayoshi Son to establish a comprehensive ecosystem centered on artificial intelligence technologies.

By the conclusion of March, the Japanese corporation had increased its investment in Nvidia to approximately $3 billion.

The combination of this investment and substantial earnings from its Vision Fund startup investment division enabled SoftBank to announce an unexpected net income of ¥2.5 trillion ($16.2 billion) in its second fiscal quarter, significantly surpassing the analysts' average projection of ¥418.2 billion.

Also Read: Hyundai Motor CEO Calls for Resilience, Adaptability

Additionally, SoftBank revealed its plan to implement a four-to-one stock division, which is scheduled to occur on January 1st.

Son's investment firm now has a collection of investments that features some of the most prestigious and highly-valued artificial intelligence companies in the global market: OpenAI and Oracle Corporation.

These investment holdings increased SoftBank's theoretical financial value and contributed to a significant 78 percent rise in its stock value during the three-month period concluding in September — representing its most impressive quarterly performance since the final quarter of 2005.

SoftBank's investment recovery rate has shown improvement, which has led Citigroup analyst Keiichi Yoneshima to revise his financial projections upward, as he noted in a research report prior to the company's earnings announcement.

The analyst established SoftBank's stock price target at ¥27,100, basing his calculations on OpenAI's current valuation and anticipating a potential future company valuation between $500 billion and $1 trillion for the ChatGPT developer.

Also Read: Japan PM Eyes Cooperation With US in Rare Earth Development

At 68 years old, Son is actively pursuing opportunities to benefit from the rapidly growing investments in artificial intelligence and semiconductor technologies, while simultaneously reducing his stakes in other sectors.

The visionary founder of SoftBank has been driving forward ambitious projects, such as the expansive Stargate data center initiative and a potential massive $30 billion investment in OpenAI. Additionally, Son is engaging in discussions with Taiwan Semiconductor Manufacturing Company and other potential partners about participating in an ambitious $1 trillion AI manufacturing project located in Arizona. Earlier in the year, SoftBank even investigated the possibility of acquiring the American semiconductor company Marvell Technology Inc.

Also Read: PM Chinh Urges International Financial Centre to Boost Growth

The primary difficulty lies in managing the financial resources required for upcoming technological investments, which include approximately $20 billion allocated to OpenAI and $6.5 billion designated for the proposed purchase of semiconductor design firm Ampere Computing LLC. Additionally, there are ongoing reservations regarding the potentially inflated market values of artificial intelligence enterprises and their substantial capital expenditures, along with uncertainties about the ultimate beneficiaries of the emerging data center infrastructure and related technological developments.